0412964164

ATTENTION: home owners & property Investors

Simple, Honest Financial Solutions for your Home & Investment Loans

Empowering Aussies to make better Property Finance Decisions, Feel Supported, Confident and Never Aloan

CLICK BELOW TO WATCH FIRST!

Next Step: Complete The Form Below And Let's Get To Work!

TESTIMONIALS

Don’t just take our word for it, see what our satisfied customers have to say about their experiences with us!

For Home Owners & Property Investors

That aren't being well looked after

I can help with any of the below..

refinancing

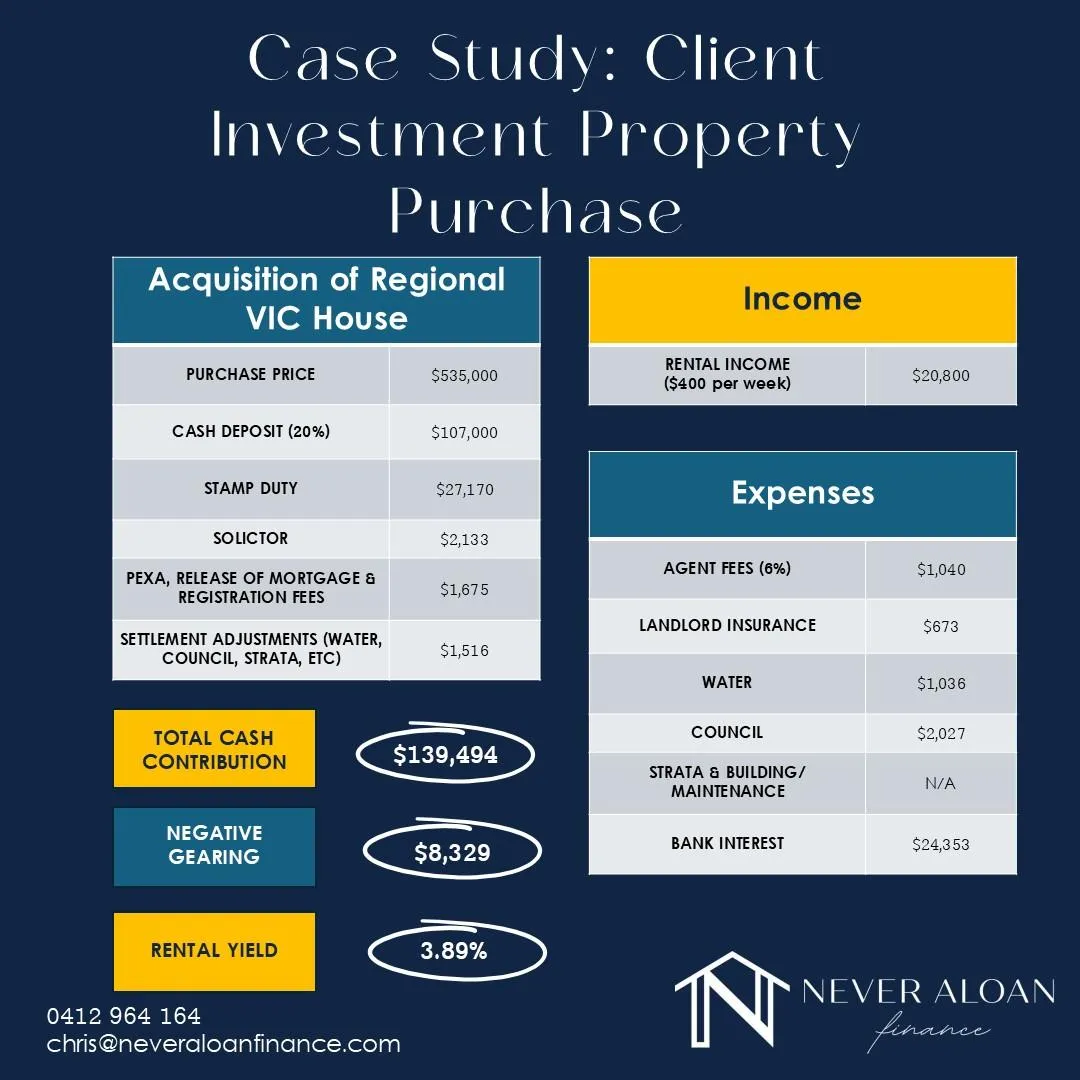

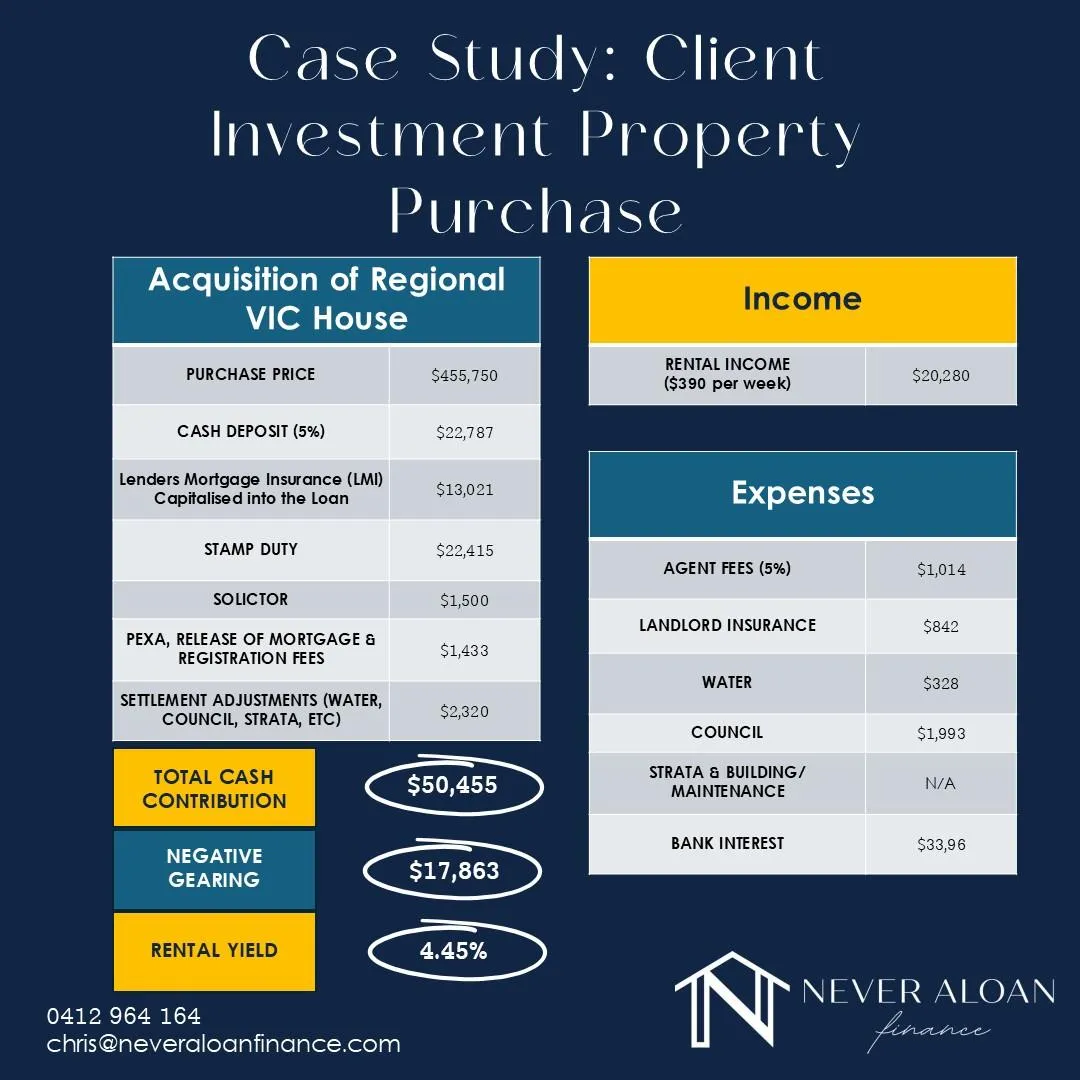

purchasing your investment property

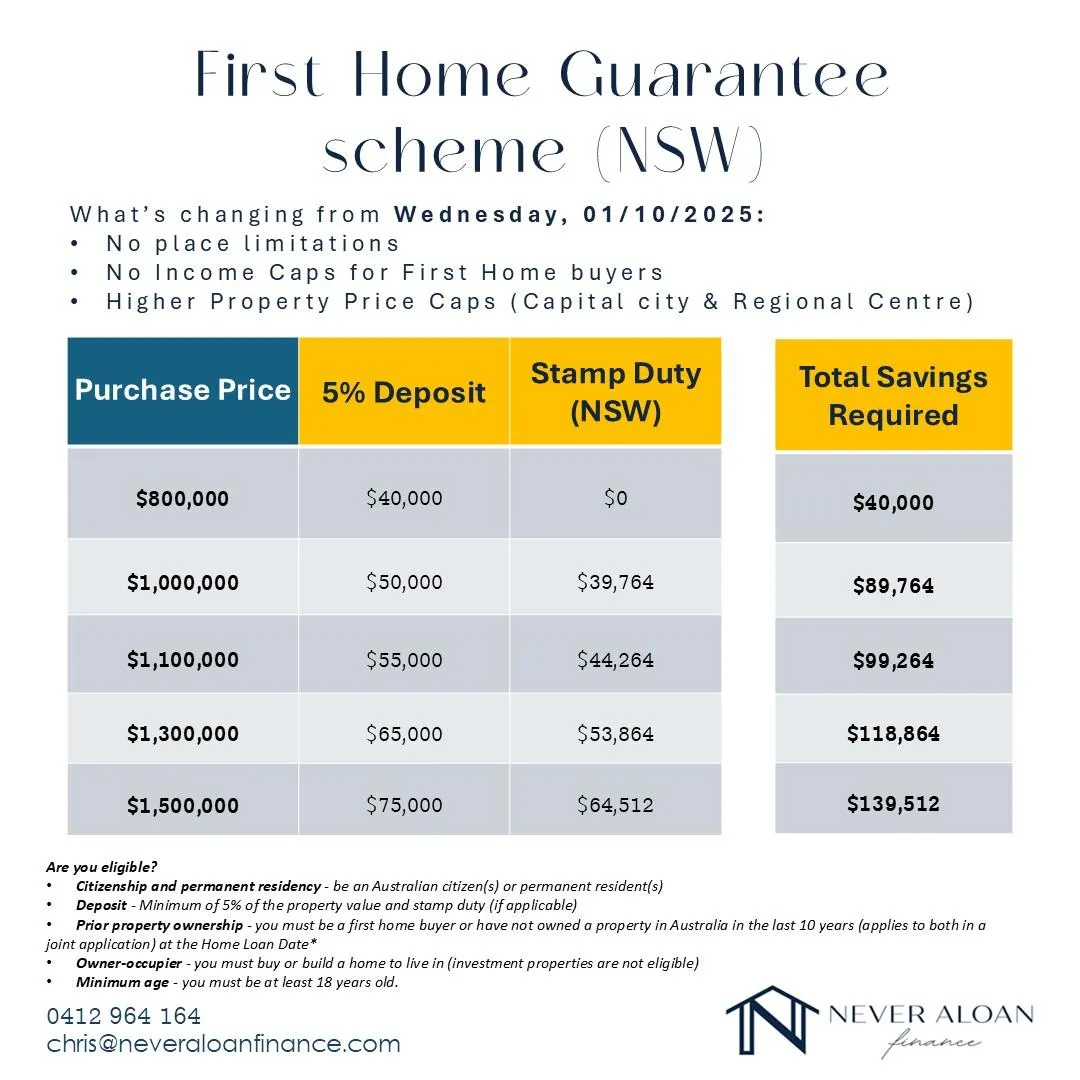

buying a home

building/ renovating

a home

bridging loans (Upgrading the family home)

private lending solutions

STILL deciding?

Frequently Asked Questions

Here's what people really want to know.

Why use a Mortgage Broker?

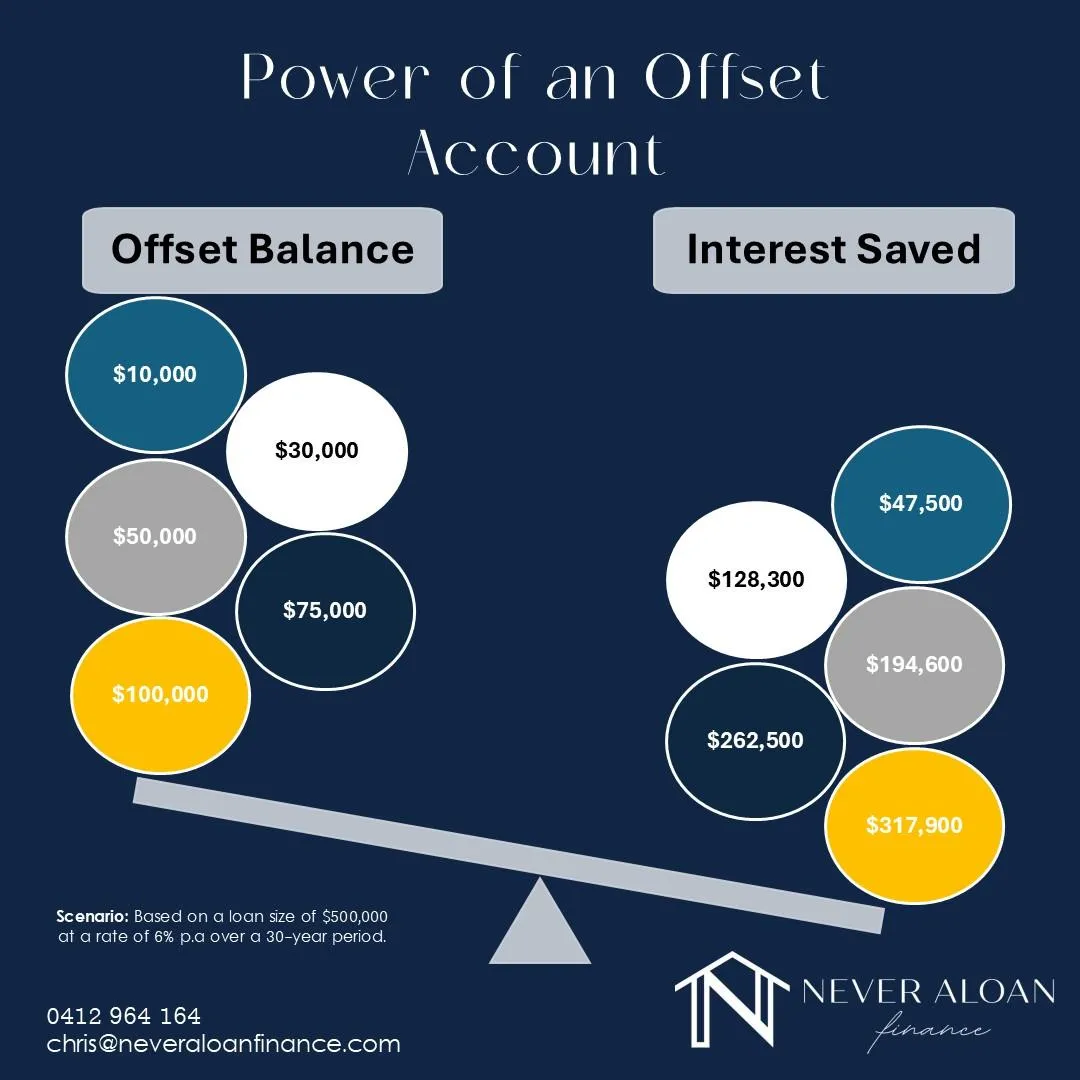

A mortgage broker will take the guess work out of finding a home loan by comparing options from a wide range of lenders, not just your current bank. I’ll guide you through the process, explain your choices in simple terms, and help you secure a loan that aligns with your goals, whether that’s buying your first home, upgrading, or refinancing.

Do you charge for your services?

No, my services are typically at no cost to you. I’m remunerated by the lender once your loan settles. The focus is always on finding the right loan for you, not on charging upfront fees.

If the Lender/ Bank pays you the commission, how will I know if Never Aloan Finance will have my best interest at heart?

That’s a fair question. As a qualified and compliant mortgage broker, I have a legal obligation to act in your best interest, something banks don’t have to do. On top of that, my business relies on long-term relationships and referrals, which only happens if I consistently put clients first.

Will I get a cheaper interest rate if I go straight to the Bank to get my Home Loan?

Absolutely not, pricing is predominately based on risk (The amount which you are borrowing and the overall loan to value ratio). Banks don’t offer special “direct only” rates. In fact, because I deal with multiple lenders daily, I often know where the sharper rates and better policies are. I can also negotiate on your behalf, something most people find difficult to do on their own.

Do you provide ongoing support and rate reviews after settlement?

Yes. Securing the loan is just the beginning. I stay in touch to review your rate regularly and make sure your loan continues to work for you as your stage of life changes. Think of me as your long-term finance partner, not just a customer that I helped once at the branch.

What are the downsides of using a mortgage broker?

There are no real disadvantages, if anything not every single lender in Australia works with brokers. That said, I have access to a wide panel of reputable banks and lenders that cover almost all client needs. If I ever think a lender outside my panel is a better fit, I’ll be upfront about it so you can make an informed decision.

How We'll Get You Home

1. Complete

the Questionnaire

Let's get to know you and your financial situation. The initial call is to better understand your financial goals, preferences and challenges.

2. Structure a Game Plan

In Finance, there are no 'one size fits all' solutions. We'll explore multiple mortgage options, clearly explain the Pros & Cons and help you make an informed decision.

3. Secure

your Future

We'll assist from application submission to unconditional approval. We'll negotiate the most favourable terms and provide ongoing support for any future needs.

What Are You Waiting For?

MEET Your Home loan Broker

Hi, I'm Chris Tanudjaja

I'm passionate about guiding Homebuyers & Seasoned Property Investors through the Lending Process with Confidence. Beyond structuring the right home loan solutions, I take pride in building long-term relationships based on trust, clear communication and a deep understanding of each client's unique financial situation.

Over a decade of experience in the Financial Services & Banking Industry

Expert in structuring complex credit and negotiating favourable terms with Lenders

Bachelor of Commerce and Certificate IV in Finance & Mortgage Broking